AlphaSense: The AI-Powered Search Engine for Financial and Business Intelligence

AlphaSense’s data sources, its underlying technology, and how it differs from competing platforms...

In today’s data-saturated world, the hardest part of investing and corporate decision-making is not the lack of information, it’s the overwhelming abundance of it. Each day, businesses, analysts, and investors are buried under a flood of earnings transcripts, regulatory filings, broker research, press releases, and news reports. Hidden within these millions of pages are the insights that can change investment decisions, shape strategy, or identify new risks.

This is where AlphaSense comes in. Founded in 2011, AlphaSense is often described as a financial and market intelligence platform powered by artificial intelligence. But that simple description undersells its role. What AlphaSense really offers is a way to make sense of unstructured business content at scale. Its technology allows users to search across millions of documents, quickly uncover patterns, and extract insights that would take days or weeks to piece together manually.

In this article, we will break down AlphaSense’s data sources, its underlying technology, and how it differs from competing platforms like Bloomberg Terminal, FactSet, Refinitiv, and Sentieo. By the end, you’ll see why AlphaSense has become a must-have tool for hedge funds, asset managers, corporates, and consultants.

1. The Problem AlphaSense Solves

Before diving into its features, let’s step back and understand the problem AlphaSense is solving.

For a financial analyst, much of the day is spent reading:

Earnings call transcripts for updates on company guidance.

SEC filings for disclosures buried in the footnotes.

Broker research to see how the Street views a stock.

Press releases and news articles for the latest developments.

Industry reports and presentations to understand macro trends.

Each of these data sources is written in natural language. Traditional databases store this information, but searching them often requires clunky keyword queries that miss nuance. For example, if you want to know how companies are talking about “supply chain disruptions,” a simple keyword search might miss synonyms like “logistics challenges,” “shipment delays,” or “inventory bottlenecks.”

Multiply that across thousands of companies and hundreds of industries, and you see why analysts struggle to keep up. Information overload is the real bottleneck.

AlphaSense tackles this by combining deep data coverage with AI-powered search and summarization, allowing users to query complex concepts, not just keywords.

2. AlphaSense’s Data Sources

A research platform is only as good as the data it covers. AlphaSense has built one of the most comprehensive repositories of business information in the world, drawing from four main categories of sources:

(a) Company Documents

Earnings call transcripts

SEC filings (10-K, 10-Q, 8-K, etc.)

Annual reports, presentations, and press releases

ESG disclosures and investor day decks

These are the bread and butter of fundamental analysis. AlphaSense ensures that all of them are machine-readable and indexed for AI search.

(b) Broker Research

One of AlphaSense’s strongest differentiators is its broker research collection, which it calls the Wall Street Insights® collection. Through partnerships with major investment banks and boutique research providers, AlphaSense gives users access to thousands of equity research reports—a dataset that’s typically locked behind expensive subscriptions.

(c) News and Web Sources

AlphaSense integrates a wide range of premium and free news outlets, industry publications, and government sites. This allows users to track breaking news and regulatory developments alongside company filings.

(d) Private Content (Bring Your Own Data)

For corporates, AlphaSense allows organizations to ingest internal documents (meeting notes, strategy decks, CRM data) and make them searchable with the same AI technology. This makes it a hybrid between an external intelligence platform and an enterprise knowledge management system.

In short, AlphaSense brings together everything an analyst might need: company disclosures, expert research, regulatory filings, and news. All indexed and made searchable.

3. The Technology Behind AlphaSense

While data coverage is crucial, the true value of AlphaSense lies in its technology layer which is the algorithms and AI models that allow users to extract meaning, not just documents.

Here are the pillars of its technology:

(a) Natural Language Processing (NLP) Search

Unlike keyword search engines, AlphaSense uses NLP to understand the context and intent of queries. For example, searching “inflation impact on margins” will return passages where companies discuss pricing pressure, cost pass-through, or wage inflation even if the exact keywords don’t appear.

This ability to surface semantic matches saves analysts from missing critical information.

(b) Synonym Recognition and Taxonomies

AlphaSense has built extensive industry-specific synonym libraries and taxonomies. This means a search for “EV” can capture references to “electric vehicles,” not “enterprise value,” depending on context. This domain-aware intelligence is a big differentiator.

(c) Generative AI Summarization

In recent years, AlphaSense has integrated generative AI features. For example:

Smart Summaries: automatically generate executive summaries of earnings calls.

Comparison Views: show how a company’s language around key topics changes over time.

Analyst-style Insights: condense dozens of documents into concise takeaways.

These features effectively act as a junior analyst, helping humans cover more ground in less time.

(d) Alerts and Monitoring

Users can set up real-time alerts for when certain themes or keywords appear in new documents. For example, a portfolio manager might receive an instant alert if “FX headwinds” are mentioned in an earnings call of a holding.

(e) Integration and APIs

For larger organizations, AlphaSense offers API access, enabling firms to plug its data into proprietary dashboards, quantitative models, or knowledge management systems.

4. How AlphaSense Differs from Other Products

To understand AlphaSense’s unique position, it’s helpful to compare it with other tools in the financial research ecosystem.

Bloomberg Terminal

Strengths: unmatched market data, real-time pricing, and trading functionality.

Limitations: while Bloomberg has a vast document archive, its search and NLP capabilities are less sophisticated compared to AlphaSense. Bloomberg excels at structured data, while AlphaSense shines with unstructured text.

Bottom line: AlphaSense doesn’t replace Bloomberg for traders, but for analysts focused on textual insights, it offers a more powerful engine.

FactSet and Refinitiv

These platforms are strong in fundamentals, estimates, and financial modeling integrations. They offer document search, but again, search relevance and AI summarization are weaker than AlphaSense’s.

AlphaSense is often used alongside FactSet, not instead of it.

Sentieo (acquired by AlphaSense in 2022)

Sentieo was a competitor focused on document search and financial modeling. With the acquisition, AlphaSense integrated Sentieo’s workflow tools (like Excel plug-ins) while strengthening its data coverage.

This has made AlphaSense even more comprehensive.

Expert Networks (GLG, Tegus)

Expert networks provide direct conversations with industry specialists.

AlphaSense complements them by providing document-driven insights at scale, while expert calls provide qualitative nuance.

In essence, AlphaSense’s differentiation is deep NLP-driven search across an unmatched set of textual data sources. Where Bloomberg gives you prices, AlphaSense gives you meaning.

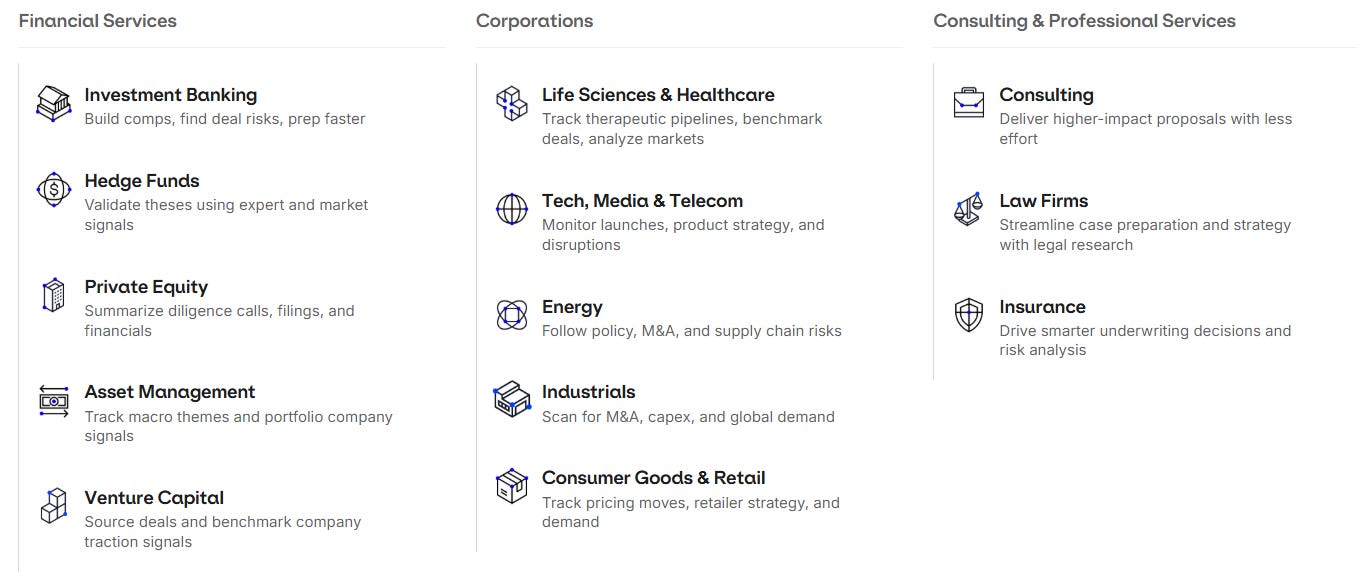

5. Use Cases: Who Uses AlphaSense and How

AlphaSense serves a broad set of users, each with different workflows:

Hedge Funds and Asset Managers

Identify emerging risks in portfolio companies.

Track competitor commentary on key themes (e.g., AI, supply chains, interest rates).

Summarize dozens of earnings transcripts in minutes.

Corporates

Monitor competitor strategy and product launches.

Track regulatory risks and ESG disclosures.

Ingest internal documents to create a single intelligence platform.

Investment Banks

Prepare for client pitches with fast access to research.

Spot shifts in sector language ahead of deal activity.

Consulting Firms

Accelerate market research.

Compare trends across industries quickly.

For all of these groups, the common thread is time saved and insights gained.

6. The Future of AlphaSense

AlphaSense is continuing to expand rapidly. Backed by more than $500 million in funding from investors like Viking Global and Goldman Sachs, the company is scaling its AI capabilities and global coverage.

The future direction likely includes:

Deeper generative AI integration, enabling automated analyst-style memos.

More private data integration, so firms can turn AlphaSense into their internal knowledge hub.

Global expansion, particularly in Asia and Europe, where coverage of local filings and news is critical.

As companies and funds grapple with ever-growing information, AlphaSense is positioning itself not just as a tool, but as the default intelligence layer for business knowledge.

Conclusion

The financial industry has always been a race to uncover information faster than the competition. In the past, that meant reading faster, hiring more analysts, or subscribing to more data feeds. Today, the edge comes from using AI to find insights hidden in oceans of unstructured text.

AlphaSense solves this problem with its combination of:

Comprehensive data coverage (from SEC filings to broker research).

Sophisticated AI search and summarization technology.

Unique positioning versus Bloomberg, FactSet, and others.

In short, AlphaSense is not a replacement for traditional terminals or databases. It is a complementary layer of intelligence that transforms how analysts and executives consume information.