Factor-GAN

How Generative Adversarial Networks Are Quietly Rewriting Factor Investing

Over the past decade, deep learning has reshaped industries from autonomous driving to medical diagnosis. Finance has been slower to change, partly because markets are noisy, partly because researchers have been cautious, and partly because machine learning models often behave like black boxes. But we are now entering a new chapter where financial modeling and AI are finally starting to merge. And one of the most interesting developments in this space comes from a direction few investors expected: Generative Adversarial Networks, or GANs.

Originally created for producing synthetic images turning doodles into photorealistic faces, colorizing old photos, or generating deepfakes, GANs operate through a clever adversarial game between a “generator” and a “discriminator.” One network tries to create convincing fake data; the other tries to distinguish fake from real. Over time, they push each other to improve until the generator becomes extraordinarily good at replicating real distribution patterns.

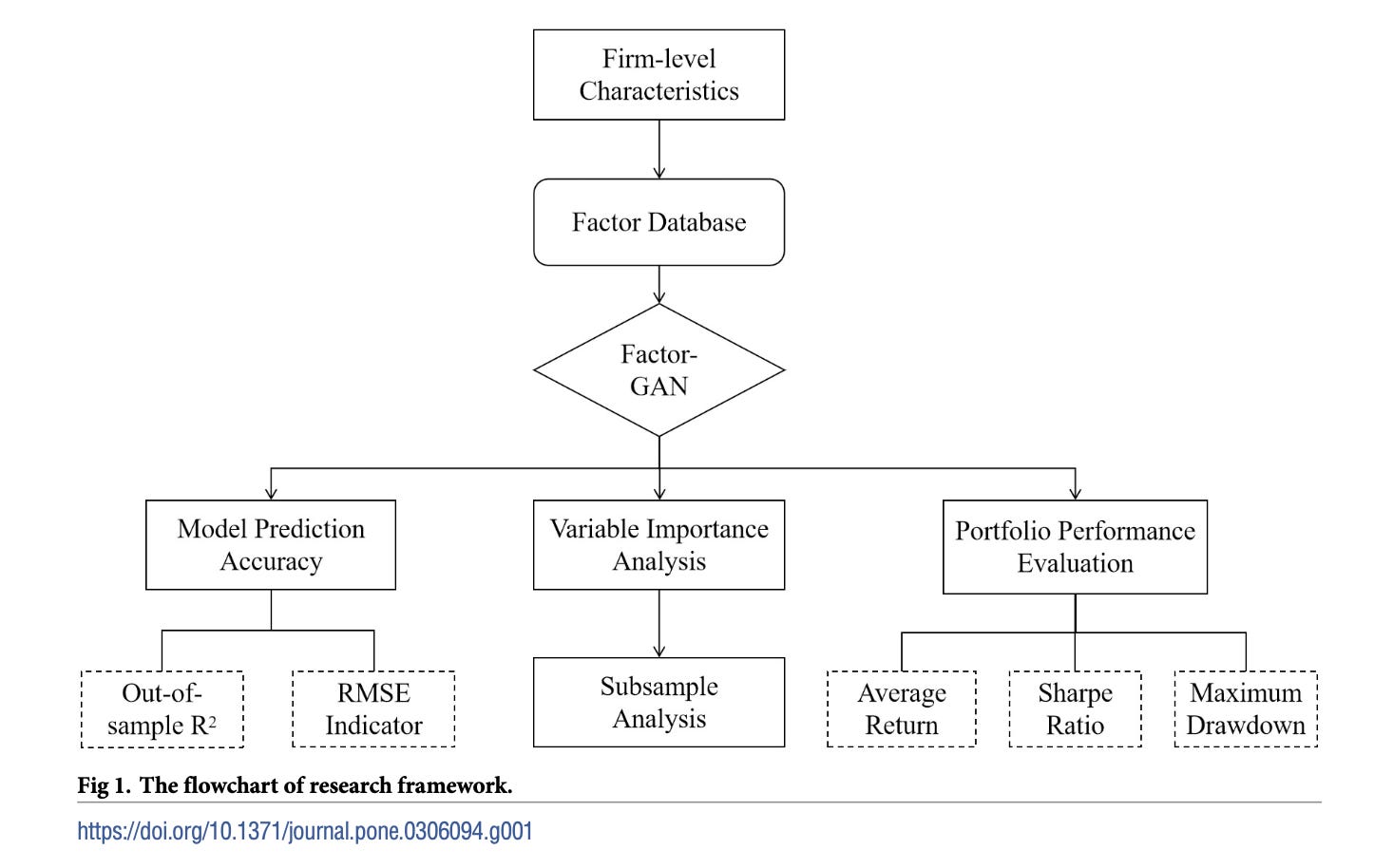

That adversarial architecture turns out to be surprisingly powerful in financial prediction. A study from Jiawei Wang and Zhen Chen introduces Factor-GAN, a new deep learning framework that applies GAN principles to stock return prediction and factor investment. Their research tests this model on nearly two decades of Chinese A-share data, evaluates seventy firm-level characteristics, and compares GANs against today’s most common machine learning methods. The result is striking: Factor-GAN materially outperforms LSTMs, neural networks, random forests, and elastic net regressions, both in forecasting accuracy and in long-short portfolio performance.

Beyond performance, the study offers something rare for deep learning in finance: a deeper look into why the model works, which factors matter most, and how their importance shifts across types of firms. For anyone interested in quant investing or the future of AI-driven portfolio construction, Factor-GAN is one of the strongest examples yet of how generative modeling can enhance empirical asset pricing.

Why Traditional Factor Investing Is Struggling

Modern factor investing still leans heavily on linear models like Fama-French regressions, cross-sectional OLS, or slight variants. These are simple, interpretable, and easy to estimate. But markets aren’t linear. Factor interactions change over time; relationships between characteristics and returns are sometimes unstable; and the explosion of available data has made feature selection increasingly difficult.

The Chinese A-share market amplifies these issues. It is noisier than developed markets, dominated by retail investors, influenced by policy cycles, and characterized by more frequent volatility shocks. Traditional models tend to overfit historical data and underperform out-of-sample in exactly this kind of environment.

This is where deep learning enters. Neural networks can handle nonlinear interactions, extract hidden structures, and reduce dimensionality without manually choosing factors. But even within deep learning, most research focuses on feedforward networks, RNNs, or LSTMs. GANs, despite their success elsewhere, have been practically absent from asset pricing.

Factor-GAN fills that gap.

What Makes Factor-GAN Different

The architecture behind Factor-GAN is elegantly designed around the strengths of two deep-learning tools:

The generator is a Long Short-Term Memory (LSTM) network that processes firm-level factor data across time and attempts to produce realistic predictions of next-month stock returns.

The discriminator is a one-dimensional convolutional neural network (CNN) that receives both real and generated returns and learns to distinguish them.

Keep reading with a 7-day free trial

Subscribe to LLMQuant Newsletter to keep reading this post and get 7 days of free access to the full post archives.