Inflation and Investor Behavior

How Rising Prices Reshape Beliefs, Expectations, and Trading Decisions

Inflation has always been one of the most persistent concerns for investors. It erodes the purchasing power of money, distorts corporate earnings, and challenges central banks. Yet, despite the centuries-old struggle to understand its effects, a striking paradox remains: if stocks represent claims on real assets, why do they often perform poorly when inflation rises?

A study published in the Journal of Financial Economics “Inflation and Trading” by Philip Schnorpfeil, Michael Weber, and Andreas Hackethal provides one of the most comprehensive empirical examinations of this question to date. The authors combine a large-scale randomized controlled trial (RCT) with actual trading data from a major German bank during a period of historically high inflation. Their goal is to uncover how investors form beliefs about inflation and how those beliefs shape both expectations and real trading behavior.

The results challenges traditional economic theory and sheds light on the behavioral mechanisms driving markets during inflationary times.

Inflation as a Behavioral Test

Economic theory suggests that equities should serve as a hedge against inflation. After all, companies own real assets and can adjust prices over time. Yet, empirical evidence points to the opposite: higher inflation tends to coincide with lower stock returns. Economists have long offered explanations from money illusion and sticky prices to inflation-induced uncertainty and tighter monetary policy. But what has been missing is direct evidence of how investors themselves interpret inflation and act upon it.

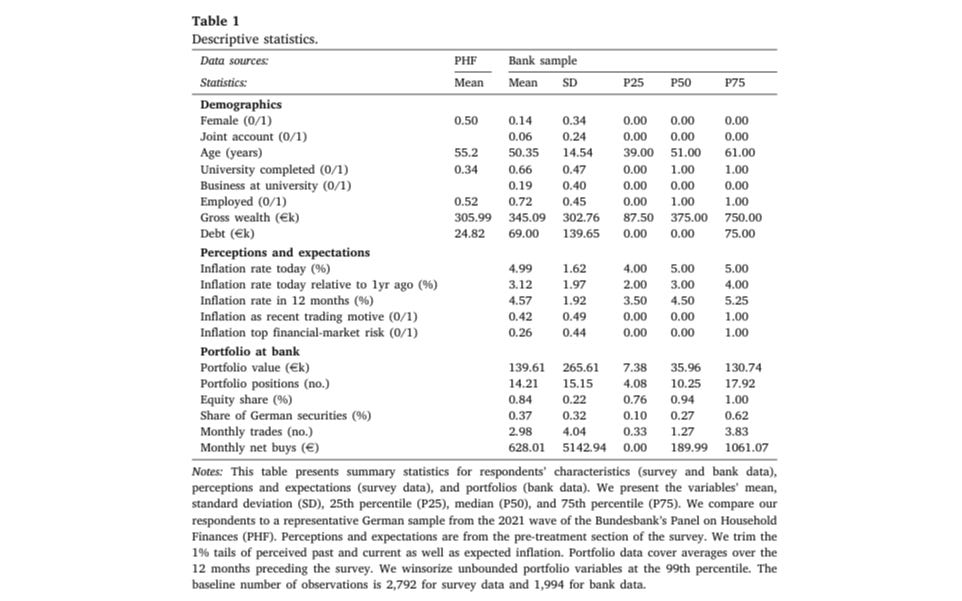

To fill that gap, the researchers conducted a unique experiment in early 2022, when Germany’s inflation reached a 30-year high of 5.3% and would later exceed 11%. They surveyed 2,800 brokerage clients of a large German bank which is a sample of self-directed investors whose portfolios and trades could be observed in real time. The experiment was designed to test how investors’ beliefs about inflation and asset returns respond to new information.

Participants were randomly assigned to one of four groups:

Control group: received no new information.

Inflation information (T1): received data showing inflation at record highs, along with reasons for the rise.

Return information (T2): received historical data showing how different assets had performed during past inflationary periods.

Combined treatment (T3): received both inflation and return information, along with brief explanations for why certain assets performed as they did.

This design allowed the authors to separate the effects of information about inflation itself from the effects of learning about inflation’s impact on asset returns.

Investors Know the Numbers But Misunderstand the Implications

The study finds that most investors were well aware of current inflation levels. Their estimates of prevailing inflation closely matched the actual data. More than 80% believed inflation was between 4% and 7%, and nearly half cited inflation as a motive for recent trading decisions. In short, awareness was not the problem.

The real issue was interpretation. When asked about how stocks had performed during previous inflationary episodes, investors were overly optimistic. On average, they believed German stocks had delivered 6.7% annual nominal returns during inflationary periods while the actual figure was just 1%. Only a minority correctly perceived the negative stock return–inflation relationship.

Keep reading with a 7-day free trial

Subscribe to LLMQuant Newsletter to keep reading this post and get 7 days of free access to the full post archives.