Riding the Curve: Understanding the Parabolic SAR Indicator

A systematic way to answer Where should I exit? And how do I stay in a trend without getting shaken out too early?

For decades, traders have searched for simple, visual, and rules-driven tools to help them navigate trending markets. Among the most enduring of these tools is the Parabolic SAR, short for Parabolic Stop-and-Reverse, created by legendary technical analyst J. Welles Wilder Jr. Before he introduced the Relative Strength Index (RSI) or the Average True Range (ATR), Wilder developed the Parabolic SAR as a systematic way to answer two deceptively difficult trading questions: Where should I exit? And how do I stay in a trend without getting shaken out too early?

The Parabolic SAR remains widely used across equities, forex, futures, and crypto markets because it translates market structure into a series of clean, dotted markers on a price chart. Its appeal is visual simplicity that the dots flip from one side of price to the other as the market shifts direction. Behind that simplicity, however, lies a complex recursive calculation that ties price, time, and volatility into a dynamic model of trend exhaustion.

The Logic Behind the Parabolic SAR

At its core, the Parabolic SAR is a trend-following indicator. It assumes that markets in strong directional movement tend to behave like a curve, accelerating until the trend eventually exhausts itself. “Parabolic” refers to this mathematical intuition: price is modeled as if it were following an upward or downward parabola, and the SAR line inches closer over time.

Wilder also embedded a deeper philosophical idea in this indicator which he summarized as “time is the enemy.” If a position fails to continue generating profits within a reasonable time window, the trader should exit. The SAR therefore accelerates toward price with every passing bar, eventually forcing a stop even if the market moves sideways. This makes the indicator extremely efficient in trending conditions, but prone to whipsaws during choppy or range-bound markets.

Another core interpretation of the SAR is its role as dynamic support and resistance. When the SAR dots sit below the price, the market is considered to be in an uptrend; those dots act as a rising support level. When the dots flip above price, the trend is considered downward, and the SAR becomes a descending resistance band. This simple switch, a dot appearing on the opposite side of price, is the signal many traders use to interpret trend reversals.

How the Parabolic SAR Is Calculated

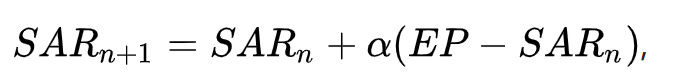

Parabolic SAR looks intuitively simple on the chart. It relies on several moving components that update at each new bar:

SAR: the predicted stop-and-reverse value for the next period

EP (Extreme Point): the highest high in an uptrend, or lowest low in a downtrend

AF (Acceleration Factor): a multiplier that increases as the trend continues

The AF is what gives the SAR its signature “parabolic” behavior. It typically begins at 0.02 and increases by 0.02 whenever a new extreme point is reached, up to a maximum of 0.20. As the AF grows, the SAR accelerates toward price, tightening the stop and preparing for a reversal.

In an uptrend, the SAR sits below price and climbs upward. In a downtrend, it sits above price and declines. When the SAR crosses the actual price bar, the trend is considered reversed. At that moment, the entire calculation resets: the AF is returned to its base value, the EP switches direction, and the SAR jumps to the opposite side of the market.

This recursive nature makes it difficult to compute accurately without code or a spreadsheet. Even Wilder recommended reading the formula carefully and studying examples line-by-line.

The Parabolic SAR in the Real World

Keep reading with a 7-day free trial

Subscribe to LLMQuant Newsletter to keep reading this post and get 7 days of free access to the full post archives.